Setting up sales tax

Setting Up Tax Calculation Using the Manual Method

Important:

This tax solution is currently available for Wix Stores, Wix Bookings, and Wix Restaurants Orders (New) & Wix Table Reservations. Using a different app? Click an option below:

Make sure you're compliant with local tax regulations by setting up tax collection in relevant locations. Learn more about figuring out where you need to collect tax.

Important:

Different tax rules apply in different regions. Consult with an accountant or your local tax authority for specific information relevant for your business.

Step 1 | Add tax locations

Start by adding the first location where you need to collect taxes. If needed, you can add additional locations.

To add tax locations:

Go to Tax in your site's dashboard.

Click +Add Location.

Select a country from the Country drop-down.

(Optional) Click the Set up tax for every region individually toggle.

Notes:Leave the toggle disabled to collect the same tax rates for the entire country.

The toggle doesn't appear for the US, Canada, and countries without separate regions.

If you enabled the toggle, select one or more states/provinces etc. from the Districts drop-down.

Click Add.

(Optional) Repeat steps 2-6 to add additional tax locations.

Step 2 | Enter your tax rates

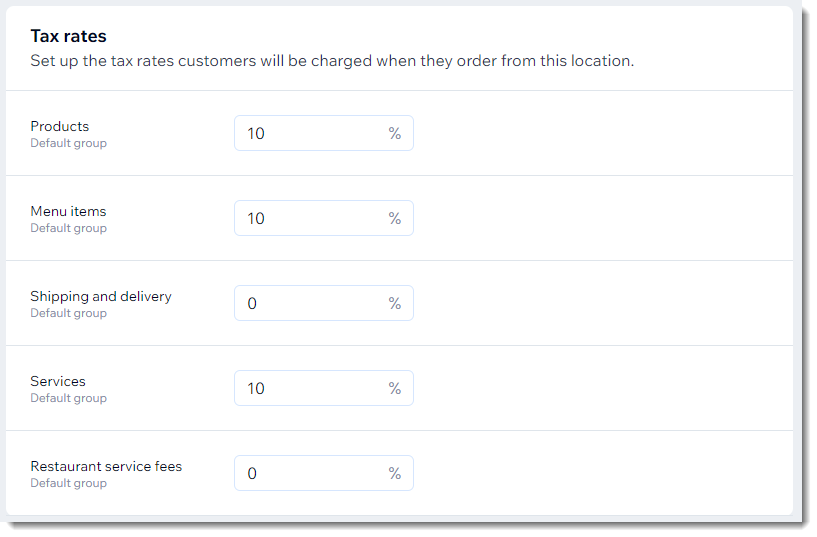

Now that you've created the locations where you need to collect tax, you need to enter tax rates for each group. You can enter a rate for products created through Wix Stores, services created through Wix Bookings, menu items created through Wix Restaurant Orders (New), and the additional costs associated with store or restaurant orders.

Tips:

In some locations, digital products and shipping costs aren't taxed as the same rate at physical products. Check with an accountant to see if you need to tax these items.

To tax digital products at a different rate, create a tax group (see below).

To enter tax rates:

Go to Tax in your site's dashboard.

Select a tax location.

Enter the rates.

If you have multiple locations, repeat steps 2 and 3 for each one.

Click Save.

Step 3 | (Optional) Customize advanced mode settings

By enabling advanced mode, you're able to customize two types of settings.

First of all, you can edit the default tax name that appears on your site (e.g. change "VAT" to "Sales tax") in each tax location. To learn more about tax names, read the FAQ below.

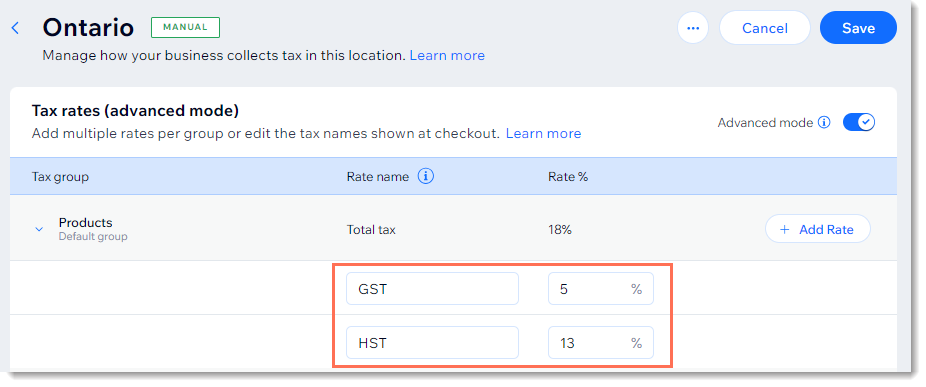

Additionally, if tax in a location is more complex and involves multiple rates, you can add them.

An example of a tax location that requires 2 rates is Canada. Besides the federal sales tax (GST), most provinces in Canada collect a provincial sales tax. So a merchant selling in Ontario would want to collect both the Ontario sales tax (HST) and federal sales tax (GST).

To customize advanced mode settings:

Go to Tax in your site's dashboard.

Select the relevant location.

Click the Advanced mode toggle to enable it.

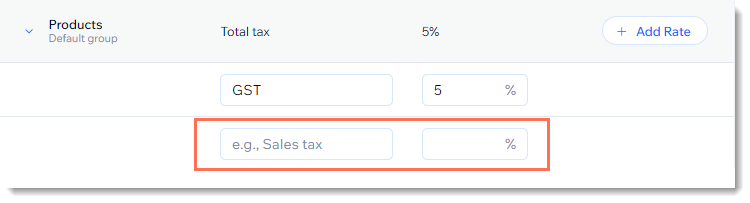

(Optional) Add an additional tax rate:Click Add rate.

Enter a rate name (e.g. GST).

Enter the tax rate percentages.

(Optional) Select the Add to all tax groups in this location checkbox.

Click Add.

Enter the second name and rate (e.g. HST)

(Optional) Repeat step 4 to add an additional rates.

Note:

If you use Wix Invoices, you'll need to enable the Tax breakdown in the total section toggle to see any additional tax rates you created. Learn more

Step 4 | Set how tax is displayed in your shop

Decide whether to display items in your shop with the tax included or add tax at checkout. Learn more about setting whether tax is included in the price.

To set how tax displays in your shop:

Go to Tax in your site's dashboard.

Select an option:Tax should be added at checkout: For example, if the tax rate is 10% and a customer buys a $100 product, they are charged $110 at checkout.

Tax is already included in my prices: For example, if the tax rate is 10% and a customer buys a $100 product, they are charged $100 at checkout.

Tax is already included in my prices: For example, if the tax rate is 10% and a customer buys a $100 product, they are charged $100 at checkout.

Step 5 | (Optional) Create tax groups

Note:

Tax groups are not currently available for Wix Bookings services.

If some of your items are taxed at a different rate, you can create a custom tax group for them.

For example, if children's car seats are tax-exempt in one of your tax locations, you can create a car seat tax group, add all the relevant products to the group, and assign the group a tax rate of 0%.

Learn how to create tax groups.

FAQs

Click a question below to learn more about collecting tax using the manual method.

What is the difference between manual and automatic tax collection?

With manual calculation, you select the location(s) where you want to collect tax and manually enter the tax rate. If the rate changes, it's up to you to update it.

Alternatively, you can calculate tax automatically through Avalara. Avalara calculates tax based on up-to-date tax rules, so that when rates change, it updates automatically. Learn more about automatic tax calculation.

How can I display tax estimates on the Cart Page?

Customers like to know what to expect before they get to the checkout. You can display an estimate of tax and shipping rate, right in the cart page.

Learn how to display tax estimates on the cart page.

How can I collect the same / a different rate for every state in a country?

Some countries collect the same tax in every part of the country. In other countries, each state, province etc. has its own tax rate. Before setting up tax for a particular location, make sure you know how tax is managed there and where you're required to collect tax.

When you add a country that has separate regions, you can choose to manage tax for the whole country. Alternatively, you can collect tax in just one or more states within a country.

To manage tax for an entire country, leave the toggle disabled.

To manage tax for one or more states or provinces, click to enable the Set up tax for every region individually toggle.

How do tax names work?

When you set up your site, you select your language & region settings.

The regional format you select determines how the tax name is displayed on your site for all tax regions.

For example, if you selected English - United States as your regional format, the default tax name will be "Sales tax" for all your customers.

In this example, if the merchant needs to collect tax in England and wants the tax name to display "VAT" for English customers, they can override the default by following the instructions Step 3 | (Optional) Customize advanced mode settings of this article. After selecting England as the location, and enabling advanced mode, enter the tax name you want to display in this location.

How can I set up tax for a home rule state in the US?

A "home rule state" is a state in the US that has cities, counties, or special tax jurisdictions with self-administered local tax authorities. These authorities collect tax independently from their states. Learn more

Home rule states include:

Alabama

Alaska (only certain parts of Alaska are home rule)

Arizona

Colorado

Idaho

Louisiana

To set up an additional tax rate in any of these areas, follow the instructions in Step 3 | (Optional) Customize advanced mode settings above.

Can I set up tax using the Wix app?

No, to set up tax for your site, you need to go to desktop.